Here’s something that’ll blow your mind: nearly 40% of American retirees have less than $50,000 saved for their golden years! When I first heard that statistic from my financial advisor buddy Tom, I nearly choked on my coffee. It got me thinking about how crucial it is to find the best bond funds conservative investors can actually sleep soundly with.

Look, I’ve been down the investment rabbit hole more times than I care to admit. Started with aggressive growth stocks in my thirties (what a disaster that was), then swung completely the other direction when 2008 hit. That’s when conservative bond funds became my best friend, and honestly? They’ve been treating me pretty well ever since.

Why Conservative Bond Funds Matter More Than Ever

Let me tell you about my wake-up call. Back in 2020, when everything went haywire, I watched my neighbor Jim lose nearly 30% of his portfolio because he was too heavily invested in risky assets. Meanwhile, my conservative bond allocation kept chugging along like that reliable old Honda in my driveway.

Conservative bond funds serve as the foundation of any sensible investment strategy. They’re designed to preserve capital while generating steady income through government bonds, high-grade corporate bonds, and municipal securities. Think of them as the financial equivalent of wearing a seatbelt – not particularly exciting, but you’ll be grateful when things get bumpy.

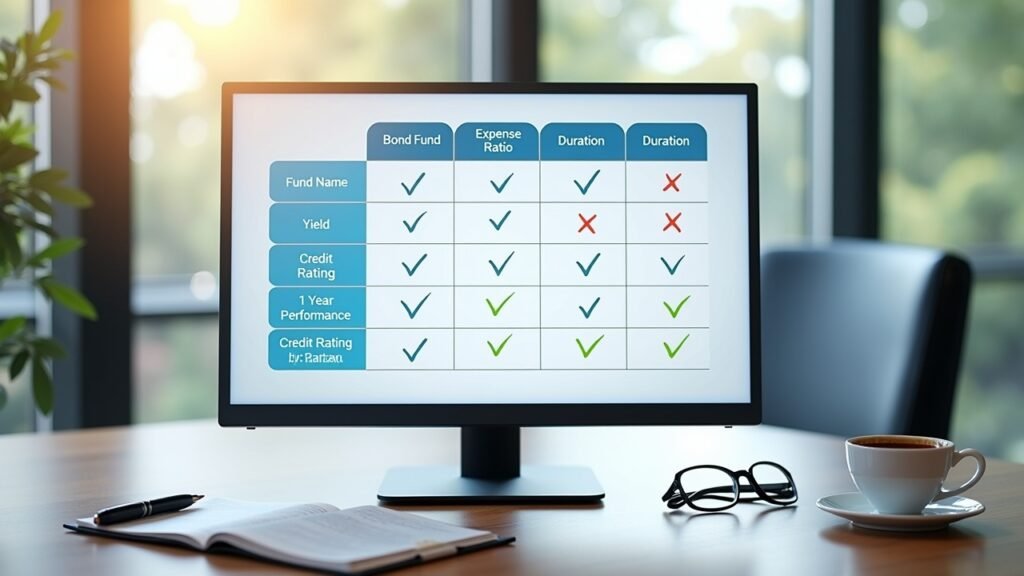

My Top Picks for Conservative Bond Investing

After years of trial and error (and yes, some costly mistakes), I’ve narrowed down my favorites. The Vanguard Total Bond Market Index Fund has been my go-to for diversified exposure. It’s like getting the entire bond market in one neat package.

For those wanting government backing, Treasury bond funds are hard to beat. I remember when my aunt Martha was terrified about losing her nest egg – I suggested she look into Treasury funds, and she’s been sleeping better ever since. The peace of mind factor alone is worth considering.

- Government bond funds for maximum safety

- Investment-grade corporate bond funds for slightly higher yields

- Municipal bond funds for tax advantages

- Short-term bond funds for lower interest rate risk

What I Learned About Duration and Interest Rate Risk

Here’s where I made my biggest rookie mistake. Duration confused the heck out of me initially – I thought it just meant how long the bonds lasted. Wrong! Duration measures how sensitive a fund is to interest rate changes, and boy, did I learn that lesson the hard way.

When interest rates started climbing in 2022, my longer-duration funds took a hit. That’s when I discovered the beauty of short-term conservative bond funds. They’re like that steady friend who doesn’t get too excited about anything – boring, but reliable.

The Fidelity Short-Term Treasury Bond Index Fund became my safety net during those volatile periods. Sometimes you gotta embrace the boring stuff, you know?

Expense Ratios: The Silent Portfolio Killer

This one’s huge, and I wish someone had hammered this into my thick skull earlier. High fees will eat your returns alive over time. I was paying nearly 1% in fees on some bond funds without even realizing it – that’s money straight out of your pocket!

Now I stick to low-cost index funds with expense ratios under 0.20%. Vanguard and Fidelity are my usual suspects here. Every penny you save in fees is a penny that compounds in your favor over the years.

Building Your Conservative Bond Portfolio

Here’s my simple approach that’s worked pretty well. I typically allocate about 60% to intermediate-term government and corporate bonds, 30% to short-term bonds for stability, and 10% to municipal bonds for tax benefits. Your mileage may vary depending on your tax situation and risk tolerance.

Don’t overthink it though. I spent months paralyzed by analysis when I first started – there’s no perfect allocation. The best conservative bond fund strategy is the one you’ll actually stick with through market ups and downs.

My Final Thoughts on Conservative Bond Investing

Look, conservative bond funds aren’t going to make you rich overnight. They’re not designed to. What they will do is provide steady income and help preserve your capital when everything else is going crazy in the markets.

Remember to consider your overall financial picture – your age, risk tolerance, and other investments. What works for me might not work for you, and that’s perfectly fine. The key is finding a balance that lets you sleep at night while still growing your wealth over time.

Always do your homework and maybe chat with a financial advisor if you’re feeling overwhelmed. And hey, if you found this helpful, swing by Budget Genie for more down-to-earth financial advice that won’t put you to sleep!